Higher utility bills are tickling the limits of people’s ability to pay, and some investor-owned utilities (IOU’s) find themselves in poor cash positions as they struggle to collect on overdue accounts. Xcel Energy of Colorado now disconnects 600-650 customers daily, and reports that nearly one in five of its customers – or about a quarter million accounts – are in arrears. Xcel’s delinquent receivables are now a record $40 million. (Story – USA Today)

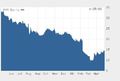

Public Service Company of New Mexico is having its own share of troubles as it tries to raise cash in the wake of a plunging stock price. PNM’s stock has recovered a bit from a low below $9 in March, but shares are still worth less than half the $35 they sold for a year ago. PNM shed its gas business in Santa Fe to raise cash, and is looking to sell other assets as well. They hope to fix their troubles by investing another $1.7 billion over the next 5 years, and concern about the rate impact of that investment has prompted Santa Fe to look into creating a public power authority.

Public Service Company of New Mexico is having its own share of troubles as it tries to raise cash in the wake of a plunging stock price. PNM’s stock has recovered a bit from a low below $9 in March, but shares are still worth less than half the $35 they sold for a year ago. PNM shed its gas business in Santa Fe to raise cash, and is looking to sell other assets as well. They hope to fix their troubles by investing another $1.7 billion over the next 5 years, and concern about the rate impact of that investment has prompted Santa Fe to look into creating a public power authority.

Much of the trouble for IOU’s began with deregulation, when utilities confessed that the assets they were holding would be much less valuable in a competitive environment. Nobody could be expected to compete with 1960’s technology running at sub-thirty percent efficiency, could they? Now as these same utilities seek another big round of investment, investors and regulators are wary. Will we get competitive investments this time around?

There are good reasons to believe the answer is “no”. If anything, the regulatory landscape has tipped even further in favor of utilities. Most notable is the new trend toward revenue guarantees that ensure utility investments can be recovered in rates even as throughput drops on the system. But investors must be wondering why they should buy assets that can be so easily bypassed with distributed generation.

Besides, investors have better opportunities in the emerging “clean tech” sector, where distributed generation and load management technologies have made bi-directional, internet-style grids a reality. The Nordic countries still lead with their “active grid” technology, wherein connected resources actively participate in the health of the network, and soon enough these companies and their investors will pry open the U.S. market.

If active grids do get built here in the U.S., where would it leave our utilities? Waving their revenue guarantees in front of legislators and demanding a bailout, is my guess. It’ll have to be the taxpayers, because ratepayers will have left the system en masse to create active grids that can operate in parallel or stand-alone at will , delivering much higher efficiency.

The local economic benefits of creating an active grid that supports local, independent energy producers are too great to ignore any longer.